estate tax form bir|Estate Tax in the Philippines: An Easy : iloilo The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a . Odd pricing refers to the practice of: charging prices that fall slightly below even dollars and cents in order to create a perception of greater value. Pentogreen, a company that manufactures soda, offers its latest products at very low prices. Pentogreen's strategy is based on the assumption that more customers will be willing to buy its .

estate tax form bir,The Estate Tax Amnesty Return (ETAR) (BIR Form No. 2118-EA July 2021 (ENCS)), together with the complete documentary requirements and proof of payment shall be filed with any Revenue District Office, on or before June 14, 2025. The payment of the Estate .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a .

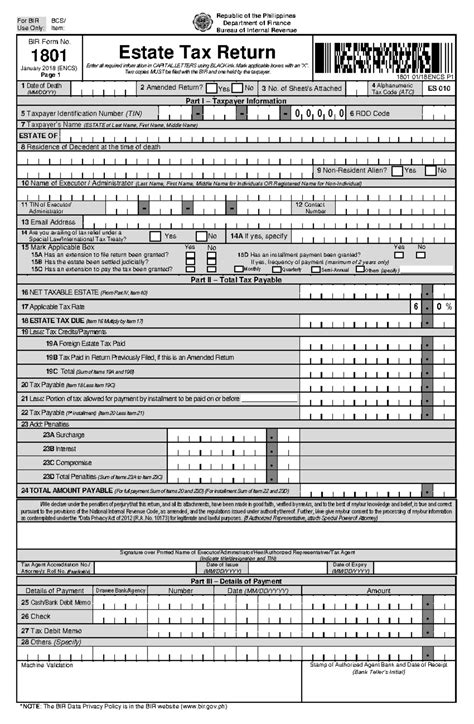

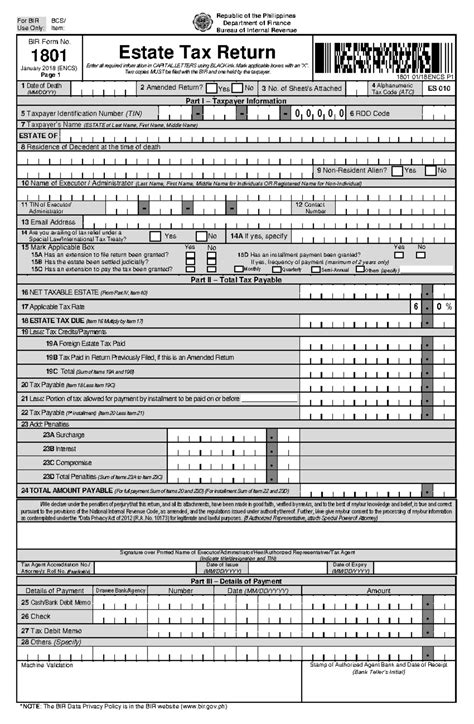

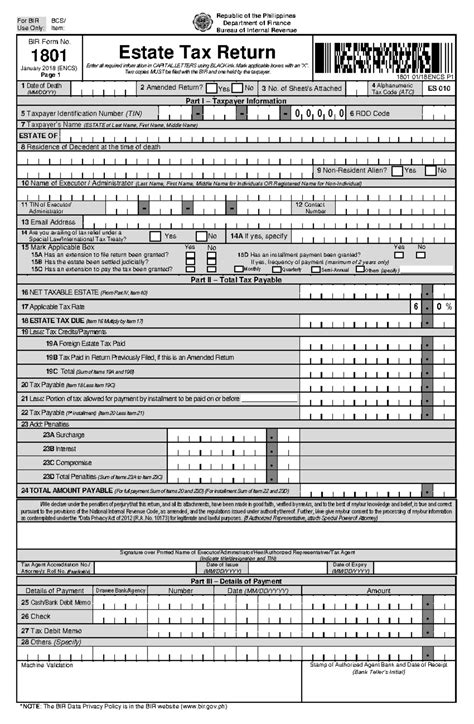

The tax amnesty due shall be paid using the Estate Tax Acceptance Payment Form (BIR Form No. 0621-EA) to the Authorized Agent Bank (AAB) or Revenue Collection Officer . Explains in detail the gross estate and deductions, how to fill up Estate Tax Return BIR Form 1801 and its attachments.The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated .estate tax form bir1801 Estate Tax Return. This BIR return is filed by: 1. The executor, or administrator, or any of the legal heirs of the decedent, whether resident or non-resident of the Philippines, .

Key Takeaways. Calculate the net estate value by subtracting allowable deductions from the gross estate. Apply a 6% tax rate uniformly across the net estate .

BIR CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR) OF ESTATE TAX. A. Mandatory Requirements (Taxable / Exempt) TIN of Estate, Executor / Administrator. .

When and Where to File a. Willful neglect to file the return within the period prescribed by the Code or This return shall be filed within six (6) months from the decedent's death. In . The Bureau of Internal Revenue (BIR) has released Revenue Regulations No. 12-2018, which contains the implementing guidelines related to the revised Estate .

The executor of the estate must file for Estate Tax Return (BIR Form 1801) within one year of the deceased person’s death. However, the BIR Commissioner can grant an extension of filing of up to 30 days. The Estate Tax Amnesty Return (BIR Form No.2118 – EA July 2021 [ENCS]), together with complete documentary requirements, shall be filed not later than July 14, 2023 by the executor or administrator, .

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .BIR CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR) OF ESTATE TAX A. Mandatory Requirements (Taxable / Exempt) TIN of Estate, Executor / Administrator . (BIR Form 1801) as proof of payment . Publication) B. Additional Requirements, if applicable 1. For Real Properties Certified True Copy of the Latest Tax Declaration . File the Estate Tax Return using BIR Form 1801 within one year of the deceased's death. Include necessary documents such as death certificate and tax declarations of assets when filing. Understanding Estate Tax. Estate tax in the Philippines is a charge imposed on the transfer of a deceased person's assets to their heirs. Under .

Within one year of the deceased’s death, the executor of the estate must file an Estate Tax Return (BIR Form 1801). However, the BIR Commissioner may allow a filing extension of up to 30 days. In addition, the estate will .

For Individuals, Estates and Trusts Enter all required information in CAPITAL LETTERS using BLACK ink. . Mark applicable boxes with an "X". Two copies MUST be filed with the BIR and one held by the Tax Filer. BIR Form No. 1701Q January 2018 (ENCS) Page 1 1 For the Year 2 Quarter 3 . using BIR Form 1905) 3. Filing the Estate Tax Return. The estate tax return must be filed with the Bureau of Internal Revenue (BIR) within one year from the date of the decedent’s death. To do so, the following documents must be prepared: BIR Form 1801: Estate Tax Return; Death certificate of the decedent; Notice of death filed with the BIR Here’s everything you need to know about the new Estate Taxes under the approved Philippine TRAIN tax reform law.. The Bureau of Internal Revenue (BIR) has released Revenue Regulations No. 12-2018, which contains the implementing guidelines related to the revised Estate Tax and Donor’s Taxes to be used starting 2018, as . This article has been reviewed and edited by Miguel Dar, a CPA and an experienced tax consultant who specializes in tax audits.. The BIR Form 1904 is a unique registration form for a unique group of people. It is used for BIR registration by one-time taxpayers (those who are paying for donor’s tax, capital gains tax, estate tax, and other .To fill out BIR Form 1801, follow these steps: 1. Obtain a copy of BIR Form 1801 from the official website of the Bureau of Internal Revenue (BIR) or from any BIR office. 2. Familiarize yourself with the different sections of the form. BIR Form 1801 is used for filing an annual income tax return for self-employed individuals, estates, and .estate tax form bir Estate Tax in the Philippines: An Easy Taxpayers have until June 14, 2021 to process and pay the estate tax under the estate tax amnesty. What BIR forms should be prepared to avail of the estate tax amnesty? The Estate Tax Amnesty Return (ETAR) (BIR Form No. 2118-EA) and the Acceptance Payment Form Estate Tax Amnesty (BIR Form No. 0621-EA).The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR . I would like to share with you the steps and tips on how to file Estate Tax Return 1801 to the Bureau of Internal Revenue. Here’s the link for the requiremen. Explains in detail the gross estate and deductions, how to fill up Estate Tax Return BIR Form 1801 and its attachments.

Certified true copy of the latest Tax Declaration issued by the Local Assessor's Office for land and improvement relevant to the date of taxable transaction (date of death) . ESTATE TAX NAME OF TAXPAYER ONETT OFFICER DATE RECEIVED CHECKLIST OF DOCUMENTARY REQUIREMENTS (CDR) CHECKLIST OF DOCUMENTARY . As executor of the estate, you must file for Estate Tax Return (BIR Form 1801), along with the said documents, within one year of the deceased person’s death. Please bear in mind that the estate will also be assigned its own Tax Identification Number (TIN). HOW TO COMPUTE YOUR ESTATE TAXES. The Bureau of Internal Revenue (BIR) has issued updated regulations for the new estate tax amnesty program to benefit more than one million heirs of the deceased. Finance Secretary Benjamin E. Diokno issued Revenue Regulations No. 10-2023 to implement these changes prescribed by Republic Act (RA) 11567 following the .Estate Tax in the Philippines: An Easy The estate tax amnesty shall cover the estate of a decedent who died on or before Dec. 31, 2017, with or without assessments duly issued thereof, whose estate taxes have remained unpaid or have accrued as of Dec. 31, 2017. The estate tax amnesty shall exclude the following:

estate tax form bir|Estate Tax in the Philippines: An Easy

PH0 · Tax Reminder

PH1 · New Estate Tax under TRAIN (Sample BIR Computations)

PH2 · How to Compute File and Pay Estate Tax

PH3 · Guidelines and Instructions for BIR FORM No. 2118

PH4 · Estate Tax in the Philippines: An Easy

PH5 · Estate Tax Computation In The Philippines [Latest: 2024]

PH6 · Estate

PH7 · BUREAU OF INTERNAL REVENUE

PH8 · BIR Checklist of Documentary Requirements of Estate Tax

PH9 · 1801 Estate Tax Return